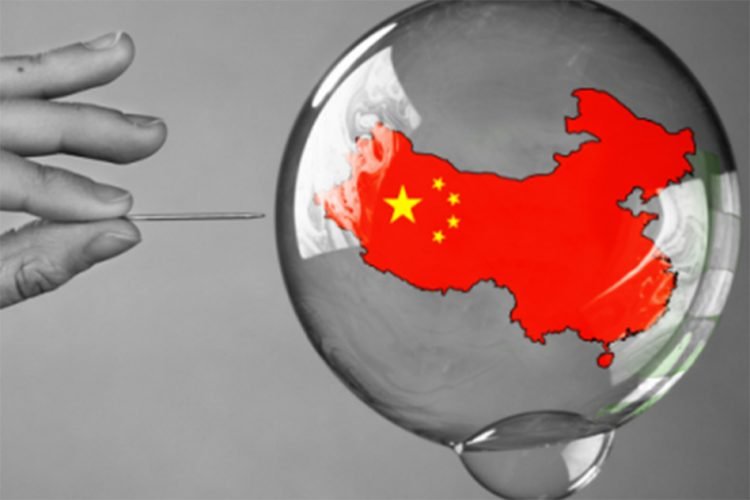

Almost

all headlines across all Financial papers, economy-related discussions, whether

online or offline start with ‘China’. It’s like the world’s sneezing just

because China has caught a cold. A very, very bad cold at that!

In

my earlier blog published in late August 2015, titled “Is the Chinese Dragonlosing fire?”, I had traced China’s growth path over the past 4 decades and the

bottlenecks thereafter it faced that eventually stalled its growth. The fallout

then wasn’t as severe for the Rest of the World as it is now. Yes, there were

losses to the tune of billions of dollars due to Shenzhen and Shanghai stock

market crashes, but prospects then didn’t seem as bleak as now in 2016.

So, what’s wrong with

China?

The

world’s most populous country has a growth rate even now that’s still faster at

6.5% than USA’s 2.5%. The Chinese numbers, the world feels, is significantly

inflated and either the top leaders are incredibly good at meeting the targets

or the analysts in China are too scared to reveal the truth. The Shanghai

composite indexes plummeted 15% at the start of 2016 and since then stock

markets world over seem to be under a Bear grip.

China's industrial

production slowed last year. Yet borrowing jumped a further 5 per

cent as banks pumped more and more money into less and less economic

factories, housing schemes and loss-making businesses. The message that the

government sent was investment in real estate is fine even if the world does

not have the appetite for its manufactures, according to Sydney Morning Herald. China aimed to keep inflating its GDP

even if the houses they built went unoccupied. Unfortunately there’s more

capital outflow from China than inflow. Investors are not as keen on China, and

local Chinese are stashing their money abroad. China’s president, Li

Xinping’s authoritarian attitude isn’t helping either.

Solution to this persisting conundrum:

There’s a possibility,

according to Bloomberg Asia that reserve requirements of Chinese banks may be

cut which will increase liquidity of banks who can therefore lend more. The

question however remains, are there companies who have the appetite and the

need to borrow more? Inept communist policies have to be redrafted, private

debt within the economy needs to be reduced, and more importantly market needs

to have a free hand to work the Yuan

The world went into

turmoil with the US subprime crisis in 2008, followed by Eurozone meltdown. Now

the Chinese seem to be riling the world with its worst economic performance in

2 and half decades. All major stock markets will get shaken since the correlation

between their performances is quite high. Well, let’s sit this one out and wait

for reassuring financial news sooner rather than later.

- -Ms. Monica Mor

Sr. Faculty, INLEAD